📝 Introduction

The year 2025 marks a defining moment for U.S. consumer finance. CFOs and financial leaders are witnessing rapid shifts—not only in revenue performance from leading banks but also in consumer borrowing behavior, regulatory tightening, and digital adoption. It’s no longer enough to analyze quarterly figures. Today’s virtual CFO must predict outcomes, adjust capital strategy, and harness data to outmaneuver risk.

This article delivers a deep dive into the Q2 financial landscape, fintech influence, and macroeconomic dynamics that matter most to finance professionals steering organizations through uncertain terrain.

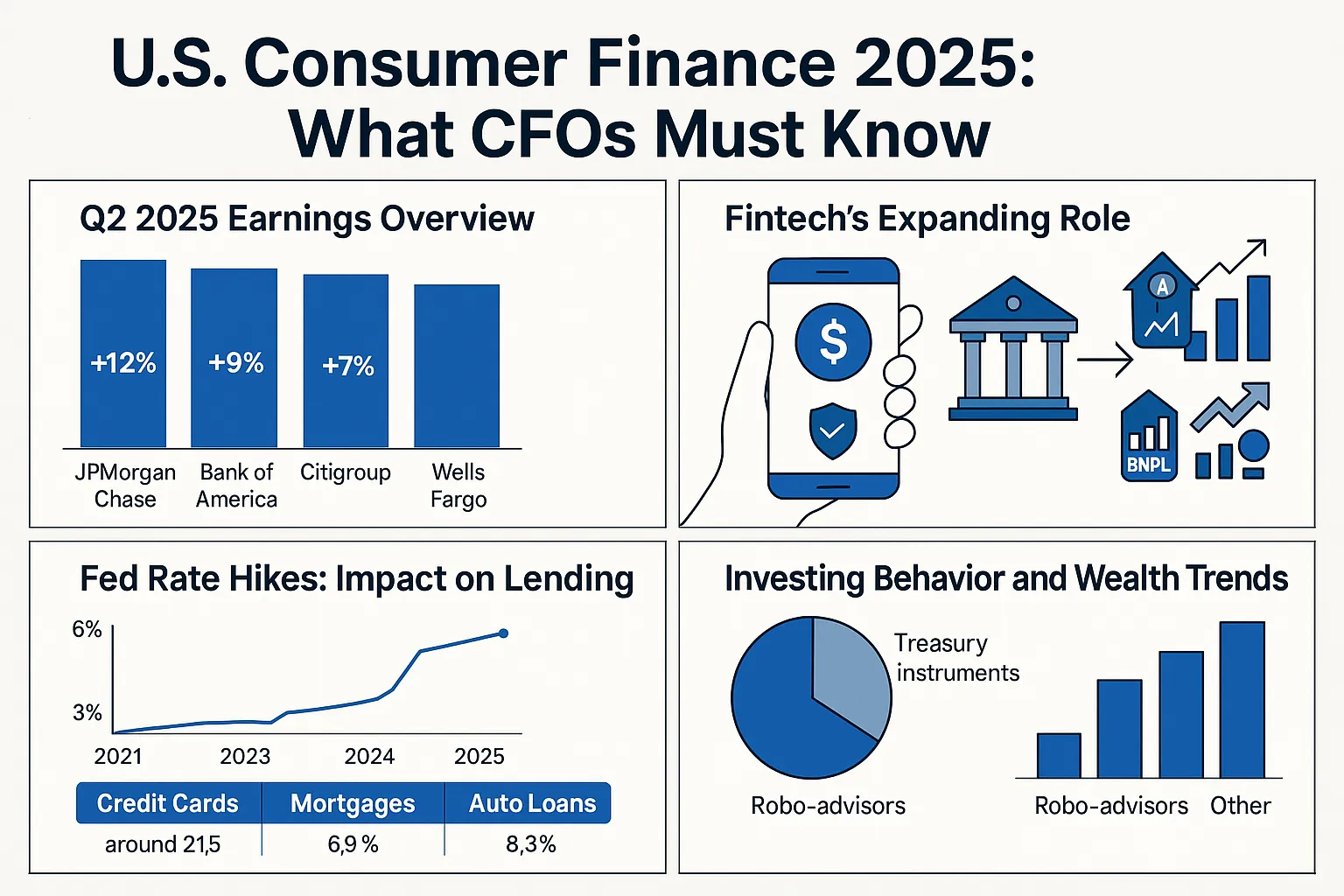

💰 Q2 2025 Earnings Overview: What Need to Know

Major U.S. banks have posted robust profits—but behind the numbers lie strategic pivots:

| Bank | YoY Profit Growth | Key Drivers |

|---|---|---|

| JPMorgan Chase | +12% | Investment banking, retail credit strength |

| Bank of America | +9% | Cost containment, digital channel growth |

| Citigroup | +7% | Corporate lending, FX services |

| Wells Fargo | +6.8% | Mortgage recovery, SME lending |

🎯 Takeaway

Banks are reinforcing digital infrastructure, tightening credit risk models, and repositioning consumer products. CFOs should monitor balance sheet reallocation and partner with digital-first institutions where feasible.

📉 Fed Rate Hikes: Pressure on Consumer Behavior

The Federal Reserve has kept interest rates elevated, tightening liquidity across U.S. markets. Consumers are responding in ways that directly affect loan portfolios, retail performance, and capital allocation.

🔹 Lending Impact Snapshot

| Product | Avg Rate (2025) | Consumer Reaction |

|---|---|---|

| Credit Cards | 21.5% | Rise in delinquencies |

| Mortgages | 6.9% | Drop in new home applications |

| Auto Loans | 8.3% | Slowed vehicle financing |

| Student Loans | 7.1% | Deferral preference increase |

CFOs must revisit receivables planning, risk modeling, and sectoral exposure assumptions for the next 2–3 quarters.

🤖 Fintech’s Expanding Role in Consumer Finance

Neobanks, embedded finance players, and AI-based platforms are pulling younger users away from traditional banks. Consumer expectations now include:

- Instant onboarding (e.g. Chime, Cash App)

- Fee-free services for transfers and lending

- AI-powered budgeting and credit tools

- Buy Now, Pay Later (BNPL) options with split payments

⚠️ Compliance Watch-U.S. Consumer Finance

The Consumer Financial Protection Bureau (CFPB) is actively reviewing BNPL, AI-driven lending models, and cross-border fintech operations. CFOs should ensure vendors and platforms meet all compliance benchmarks.

📊 Investing Behavior and Wealth Trends

Rising interest rates and uncertain macro signals have pushed consumers toward safer assets and digitally managed portfolios.

🔹 Top Investment Shifts–U.S. Consumer Finance

| Investment Type | Popularity Score | CFO Consideration |

|---|---|---|

| Treasury-backed savings | High | Recommend conservative options |

| Robo-advisors (e.g. Betterment) | Rising | Assess algorithmic risk models |

| Crypto | Stabilized | Low volatility assets preferred |

| REITs & Alt-assets | Moderate | Increased hedge demand |

Virtual CFOs are advised to educate clients and internal stakeholders on structured diversification strategies and tech-enabled wealth tools.

📡 Outlook: What’s Next in U.S. Consumer Finance?

Here are five bold predictions for the next 6–12 months:

- Fintech + Banking M&A will increase for scaling infrastructure

- AI in Credit Scoring will see federal oversight

- Retail lending margins will shrink due to rate pressure

- Personalized finance platforms will dominate loyalty metrics

- SaaS-based CFO tools will be essential for cash flow management

CFOs who embrace scenario planning, automation, and open-data ecosystems will stay ahead of the curve.

✅ Strategic Conclusion-U.S. Consumer Finance

In a post-rate-hike, tech-integrated financial ecosystem, agility matters more than ever. CFOs must evolve from number-crunchers to strategic orchestrators—balancing risk, tech, compliance, and stakeholder value. U.S. consumer finance in 2025 is no longer linear; it’s adaptive, predictive, and deeply connected to broader market signals.

Stay updated, stay curious—and lead with insight.

❓ FAQs on in 2025

What’s the safest investment option today?

High-yield savings, Treasury bonds, and diversified ETFs are top choices in a volatile rate environment.

Should CFOs recommend partnerships with fintech platforms?

Yes—if the platforms are transparent, secure, and compliant.

Will credit risk worsen in H2 2025?

Yes—especially for unsecured consumer credit. CFOs must monitor loan performance data closely.

How should virtual CFOs respond to AI-driven disruption?

Understand the algorithms. Review data governance. Lead responsibly.

📬 Want more strategic briefings like this?

Subscribe to WorldVirtualCFO.com for weekly updates on fintech innovation, market strategy, and CFO-grade analysis.

💼 Empower your decisions. Shape the future of finance.

Disclaimer

This article relies on internal data, publicly available information, and other reliable sources. It may also include the authors’ personal views. However, it’s essential to note that the information is for general, educational, and awareness purposes only—it doesn’t disclose every material fact. This analysis is for informational purposes only and does not constitute financial advice. Consult a professional before making investment decisions.

We publish information on World Virtual CFO in good faith, solely for general information. World Virtual CFO doesn’t guarantee the completeness, reliability, or accuracy of this information. These are our views for informational purposes. When you use our website, know that any action you take is entirely at your own risk. World Virtual CFO won’t be liable for any losses or damages connected to your use of our website. For detailed information, refer to our disclaimer page.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.

Comments are closed.