- What is Cost Optimization?

- How to Reduce Business Expenses

- What Is Cost Reduction?

- Difference Between Cost Reduction and Cost Optimization

- 28 Best Cost Optimization Techniques

- 1. Set Realistic Goals To Achieve Cost Optimization

- 2. Digitalization Of Your Business Processes

- 3. Use the Latest Technology For Business Processes

- 4. Optimize The Workforce And Have Virtual Meetings

- 5. Opt for A Cloud-First Policy Where Applicable

- 6. Consolidate Organization Data Centers

- 7. Evaluate Your Business Expenses

- 8. Get Staff Support

- 9. Develop Continuous Improvement Culture For Cost Optimization

- 10. Upgrading Business Efficiency Through Analytics

- 11. Hire Remote Employees And Freelancers

- 12. Reduce Financial Expenditures To Achieve Cost Optimization

- 13. Think Bartering And Co-Marketing

- 14. Simplify Your Products And Services

- 15. Enhance Staff Productivity For Cost Optimization

- 16. Reward Your Profit-Generators

- 17. Commission Your Sales Team To Get Cost Optimization

- 18. Hire Smart, Efficient, And Inexperienced Talent.

- 19. Get Trainees To Get Cost Optimization

- 20. Treasury Management

- 21. Be On Top Of Your Taxes

- 22. Pool Buying Power To Get Cost Optimization

- 23. Do Not Purchase In Bulk

- 24. Monitor Inventory Closely To Get Cost Optimization

- 25. Invest in Better Systems And Technology

- 26. Team Up With Business Transformation Experts

- 27. Dump The Traditional Platforms

- 28. Leverage Low Code Systems

- Conclusion

- Disclaimers

What is Cost Optimization?

Cost optimization is a process for reducing costs within an organization while focusing on business value. Or

It is a business-centered, continuous process to drive spending and cost reduction while maximizing business value.

This technique involves:

- Obtaining the best price and terms for all business purchases for business purchases

- Standardizing, and rationalizing platforms, applications, processes, and services and simplifying costing technologies

- Automating and digitizing IT and business operations for cost reductions across an organization

How to Reduce Business Expenses

Cutting costs in business can be difficult if you don’t aware of where to start. There are several ways to cut costs than leaving the creamer out of the comfort room. Serious expense reduction needs honest thought and an organized approach so that you can lower waste without impacting the quality of your services and products.

But it is not so easy. In fact, a lot of organizations focus on the wrong strategies to save pennies instead of making suitable investments that will save them way more.

If you are looking for methods to reduce costs and improve efficiency in your organization, you are in luck. There is a number of strategies you can deploy to cut expenses without cutting your staff or benefits.

What Is Cost Reduction?

Cost reduction is the process to reduce costs and increase their profits. It Depends on a company’s services or products, the strategies can vary from organization to organization. Or

Cost reduction is the process of lowering a company’s expenses to optimize profits. It involves identifying and cutting expenditures that do not add value to customers while also optimizing processes to improve efficiency. Cost reduction basically focuses on producing short-term profits.

If your approach to cost reduction is from an elimination-only attitude, you are losing out on a lot of other very useful strategies. Strangely, you could really finish up costing your business more.

Some cost-saving approaches are below:

- Adaptation: Modifying to customer and market demands with rangy solutions.

- Combination: Tie goods and services across an organization to lower costs.

- Elimination: Remove unwanted products, processes, benefits, and workflows.

- Optimization: Streamlining processes, systems, and workflows to cut bottlenecks and redundancies.

- Substitution: Replace high-cost products or services with cheaper products or services by keeping quality in mind

- Repurposing: Utilize existing tools, technology, and processes in new, different ways that meet demands.

Difference Between Cost Reduction and Cost Optimization

Cost optimization is a continuous process, a business-focused control aimed at maximizing business value while reducing costs. Cost reductions are short-term moves to decrease expenses.

28 Best Cost Optimization Techniques

1. Set Realistic Goals To Achieve Cost Optimization

Before you start planning how to reduce costs, you need to set realistic goals. In this way, you can quickly find out if your initiatives are successful. Goals should be specific, realistic, and explained. And you require to set milestones for measuring progress. Be SMART-

- Specific

- Measurable

- Achievable

- Realistic

- Time-bound

2. Digitalization Of Your Business Processes

Moving organizations toward the next levels of appreciation for business processes as critical corporate assets remains a challenge in the digital business area. Establish an integrated approach that integrates together required competencies and expertise, along with buy-in from the executive leadership team. Developing process management as a part of the enterprise stuff will ensure change becomes a continuous normal process.

3. Use the Latest Technology For Business Processes

In the present digital world, cost optimization is about improving business performance through technology investments. Though, these investments should be honest. The important point is to have proactive processes in place — and establish them on a going basis, upgrading your tech and exploring new opportunities.

Use modern tech whenever you think to save money and take your business forward. From virtual meetings and online payment systems to free tools like zoom, Trello, and Google Docs, for data organization and employee alliance, there are several ways you can save business costs with tech.

Tools and gadgets also assist employees to concentrate on work, which saves money and time on logistics. Use chat apps to minimize unwanted phone calls and face-to-face interactions. Also, you can streamline operations by shifting from paper to digital checklists: it is time-efficient, and it can cut many of your equipment costs.

Also, start to conduct your technology audit. How many paid apps does your business presently have? Are you sure all are in use? If an app is not in use for the last 90 days, it’s time to discontinue the subscription and stop spending money on what you do not require.

Make it a habit to review all the paid tech once every two months. More than that, try to use their free versions before paying for the premium one: Make sure it’s an app you wisely require for a business.

4. Optimize The Workforce And Have Virtual Meetings

Use workforce management application capacities like automation of manager experience or virtual assistants for regular and common tasks to lower staffing costs. Implement bots to boost the capabilities of human workers and enable a more productive work environment.

Next time you have a meeting with your customer in another city, request a Skype call or zoom meeting. Using the latest technology, you can save a lot on travel costs.

pushing for a Skype call or zoom meeting even when the meetings are within the same city. You know that a first meeting is important and should be done face-to-face but all follow-up meetings can be done virtually.

5. Opt for A Cloud-First Policy Where Applicable

Opting for a cloud-first policy provides a spectrum of competencies ranging from infrastructure as a service (IaaS) to software as a service (SaaS). While a number of private and public sector organizations adopt cloud services for enhancing agility, flexibility, and scalability, they also enjoy cost efficiencies over a period of time. To achieve your cost savings target, perform strict cloud governance or risk seeing improvements in infrastructure and application costs if governance is weak.

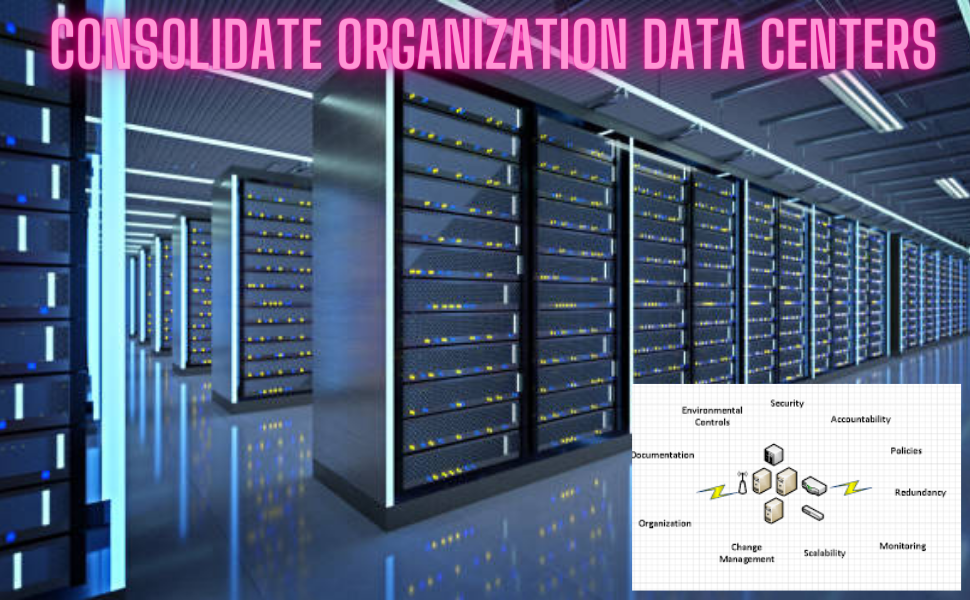

6. Consolidate Organization Data Centers

As organizations grow their operations, the cost of sustaining a traditional data center will also increase. This drives some IT companies to shift their data centers to data-center switching architecture. Through data center updation and consolidation efforts, cost savings can range between around 12% and 20% of a data center budget.

Use enterprise information management to consider data as a company-wide asset. This means people from across the organization will have access to data and will be able to share and use that data to develop business value through better and faster decisions making.

- Organization

- Documentation

- Environmental control

- Security

- Accountability

- Policies

- Redundancy

- Monitoring

- Scalability

- Change management

7. Evaluate Your Business Expenses

You should be to evaluate what your organization spends money on. Study all the data for expenses. You should able to build both a snapshot and an item-wise list of expenses. This will help you check where your money is going. Generally, this is a faster way to identify leakage of money.

8. Get Staff Support

Changing your organization’s attitude on cost optimization is key to success. Tell the benefits of reducing waste in your organization. And meet with departmental leaders to emphasize the importance of their role in helping the business optimize costs.

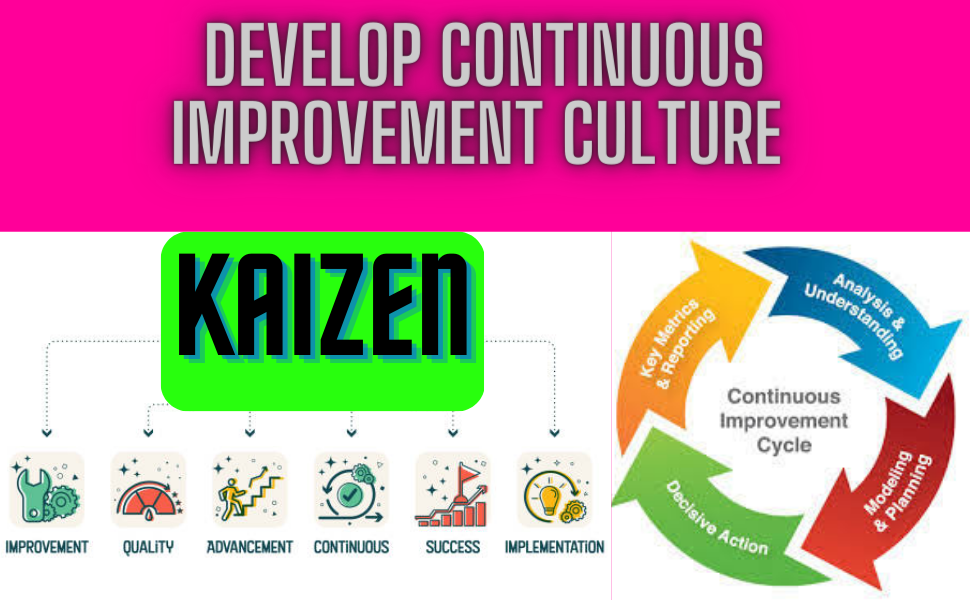

9. Develop Continuous Improvement Culture For Cost Optimization

Organizations sometimes become bound by the mindset of “this is what we have always done,” which can generate waste. CIOs require to work collaboratively with business owners to identify and remove these unnecessary items, which is usually in the form of reworks or delays due to issues further up the line, to concentrate on lean improvement efforts. Use KAIZEN

10. Upgrading Business Efficiency Through Analytics

Do not disesteem the value of analytics beyond traditional business intelligence. Not only can advanced analytics improve lives, lower customer bubbles and make equipment safer, but utilizing the furnished information to gain even single-digit percentage advancements in areas like customer retention or marketing responses can have a huge impact on the business.

11. Hire Remote Employees And Freelancers

A number of people work remotely than ever before. Hiring remotely can save money on office space, and office expenses around $10k to $15k per employee per year. And while self-employed freelancers, specialists, and contractors may have higher hourly rates, they do not require benefits.

Reports also show that remote employees are happier in their jobs and as a result, more effective and efficient in their work. Additionally, a remote employee means fewer sick days and higher productivity levels.

The chances are that you are already aware of why enterprises should hire remote employees, it’s all about efficiency, flexibility, and better productivity. And saving money.

Remote employees save you lots of costs, eliminating the requirement for office equipment, staff welfare, king-size office rental, etc. Yes, it sounds like raw maths, but see long-term savings and your employees’ work-life balance.

According to studies, remote employees determine 82% less stress, better focus, and productivity. They are techie, ambitious, and more results-oriented. More than that, remote employees are more loyal to their business organization.

Absolutely, you have to be technically prepared for working with remote employees and managing them the best you can think of project management tools, video conferencing capacities, remote access tools, etc.

And you shall not need to worry about your remote employees’ accountability, there’s quite a wide choice of time management apps that can help both you and your remote employees with staying on track. Additionally, time management tools have other useful tools for managers as well, such as project time tracking or shift scheduling.

12. Reduce Financial Expenditures To Achieve Cost Optimization

Businesses lose lots of money on things such as high fees on business credit cards, delay loan payments, or crazy insurance policies. By taking a closer view of your financial accounts and adopting automation of as many financial processes as possible, you can optimize business costs by far.

First, adopt and implement an online payment system and set up alarms to avoid overdue bills.

Then, ask your credit card processing firm for a reduced rate, especially if you have been using their services for a long time. Visit your bank and ask what best options they could offer business owners like you. It would not lower expenses with a wave of a hand, but it is a smart move toward your financial health in the long term.

Also, look at your insurance policies re-evaluate them, compare the plans with other providers, and consolidate policies if possible. And do a cost-benefit analysis to avoid unnecessary debt.

13. Think Bartering And Co-Marketing

Bartering is an exchange of products and services. For example, you have a small writing business where you are a great essay generator but do have not enough time or skills to market your services. Why do you not offer your writing services to others who had organized a marketing campaign in return?

With such a bartering adjustment, you can cut business costs too. B2B barter websites like TradeBank, bxiworld.com, or U-Exchange are gaining popularity, so go it a try. Besides the financial benefits, it’s a great chance to expand business connections and find new customers or partners.

Co-Marketing

There are a number of methods to approach co-marketing: exchange advertising spaces with fellow business entrepreneurs, share mailing lists, promote each other business, publish content on each other’s blogs when relevant, etc. It will save time and money for ads but increase your rankings, attracting new potential customers.

While most exchange credits are utilized for publicizing media, it is vital to take note that the scope of what a corporate deal organization can give is extending to incorporate air travel, lodgings, deals gatherings, airship cargo, collaborating spaces, journey compartments, vehicle rentals, limousine administration, and such.

The pandemic has made a disturbance for little and medium organizations more than it accomplished for enormous organizations. The credit plans of the public authority didn’t actually help a considerable lot of them, as there were no development possibilities for quite a long time.

Also, expanded contests from a similar industry as well as from substitute items made it much more difficult generally speaking. An ever-increasing number of firms have begun to consider the utilization of corporate deals as reasonable and significant showcasing systems, not similarly as a method for taking care of monetary issues.

“Retail” deal trades will be exchanges of items and administrations among neighborhood private companies and people, each paying the exchange trade an exchange charge. By examination, corporate bargain organizations take title to the actual merchandise. Exchanges can include crores of rupees of labor and products and are led basically by huge organizations – as a rule, public ones.

14. Simplify Your Products And Services

Revisit the products and services you offer and eliminate repetitions. Banks and other classical financial institutions bear to keep adding products and services without eliminating existing ones that are closely linked. This practice enhances complexity and costs as all your offerings are usually sold and supported by different underlying processes, added by a number of channels.

According to PERT analysis, “In many cases, we have found that only 20% of products deliver over 80% of revenues and an even greater percentage of profits.” To enhance your financial institution’s efficiency, find which of your offerings are worth continuing and which can be eliminated.

Even before you think of digitization, cut the unwanted complexity caused by repetitive products and services. Customers in rare cases miss those that are eliminated as their functions are generally present in the remaining set of offerings. Then you’ll spend far below on digitization and still be able to satisfy your customers’ requirements.

15. Enhance Staff Productivity For Cost Optimization

Closely monitor the teams and departments in your organization to make sure they’re working as efficiently as possible. Simplify and redesign organizational design if you can. You may be able to integrate or centralize some roles or restructure departments to be more effective and productive.

And never overlook the apparent. Examine ways you can benefit from developed performance management systems, such as clearly defined expectations, goals, increased motivation, and rewards systems, and upgrade training and supervision. Bonuses or similar incentives offered for a team or individual excellence can be particularly effective.

Flexible work options can also increase productivity and lower operating costs. For example, allowing workers to work from home at least part-time cuts company costs dramatically. As per a study based on conservative assumptions, Global Workplace Analytics predicts a typical U.S. employer can save an average of $11,000 per half-time teleworker per year. Not only that, but employees who work from home are often more efficient and productive. Recent studies show productivity increases by 13-47% when employees work remotely.

16. Reward Your Profit-Generators

It can be a little contradicting, but spending to save makes sense in some cases. In my opinion, would suggest taking the proactive approach of rewarding a profitable attitude from both your workforce and your customers. You can begin by making small actions, like an occasional free lunch or a treat, to motivate employee morale and create positivity at the workplace.

It can also mean offering bonuses to employees who achieve certain cost-saving targets set for that year and offering more discounts or value-added packages to your most loyal customers. If you’re spending a little money on the workforce who do the best work for the business or buy the most product from you, you are simply investing in a relationship that will ultimately generate more profit for your business.

Benefits Remote Employee

The chances are that you are already aware of why enterprises should hire remote employees, it’s all about efficiency, flexibility, and better productivity. And saving money.

Remote employees save you lots of costs, eliminating the requirement for office equipment, staff welfare, king-size office rental, etc. Yes, it sounds like raw maths, but see long-term savings and your employees’ work-life balance.

According to studies, remote employees calculate 82% less stress, better focus, and productivity. They are techie, ambitious, and more results-oriented. More than that, remote employees are more loyal to their business organization.

Absolutely, you have to be technically designed for working with remote employees and managing them the best you can think of project management tools, video conferencing capacities, remote access tools, etc.

And you shall not have to worry about your remote employees’ accountability, there’s quite a broad choice of time management apps that can help both you and your remote employees with keeping on track. Additionally, time management tools have other useful tools for managers as well, such as project time tracking or shift scheduling.

17. Commission Your Sales Team To Get Cost Optimization

Overhead, salaries, incentives, training costs, fringe benefits, and expenses add up when you’re hiring your own sales forces. Tieing up with independent manufacturers’ sales representatives, paid on commission only, is less costly and often equally effective.

If you consider having an in-house sales team, try to structure their salaries in such a manner that a larger percentage is allocated to commission and to link with performances and a fixed component of salary is on the lower side.

18. Hire Smart, Efficient, And Inexperienced Talent.

Experience is essential but it is not everything, and it attracts at a cost. Most technology companies now hire fresh college graduates and then train them for a month or two. It appears to be very cost-effective than hiring an experienced employee. For critical work situations, you have no choice but to go for an experienced talent but in most cases, the approach of training freshers works.

You will not only gain monetary benefits by providing entry-level remuneration but you will also advantage by having talents who are enthusiastic, up-to-date on the latest technology, nimble, and eager to learn.

19. Get Trainees To Get Cost Optimization

In addition to the above cost-saving idea, financial consulting firm – WVCFO advises hiring trainees. Usually, trainees work for 2 to 6 months depending on their academic needs.

There are a lot of non-critical tasks that can be delegated to trainees. They are enthusiastic and energetic. Firms usually hire trainees for market research and engage them for a duration of 2-6 months. Sometimes trainees are ready to work free of cost and if they are really adding value, you can hire them as a permanent employees.

Interns are effective for activities like social media promotion, back office administration, market surveys, or other short-term activities.

20. Treasury Management

This may sound great as a major word for startup organizations, however, it’s one of the successful approaches to creating cash on ideal assets. The ongoing Record with the bank gives no revenue on ideal subsidizes in the record. One can put by means of Shared Assets underwater assets for a term as low as 2 days and anticipate the conditional interest of -8% p.a.

There is an internet-based venture office these days with zero desk work. Any limited quantity created can deal with your telephone or power bills!!

21. Be On Top Of Your Taxes

Close to year-end, schedule a tax-planning meeting with your finance head to change income and expenses. For example, switch receivable income to the next year to lower this year’s taxes. Your finance head will be the right person to suggest you.

Again, using good accounting software from the start of your venture can save you a lot of time & energy during year-end tax planning and preparation.

22. Pool Buying Power To Get Cost Optimization

In the present scenario, home buyers come together and manage to get a better deal from the builder.

Find other small-business entrepreneurs and collaborate with them to save money on supplies and other products.

You can also save money while importing goods from another country. Mr. X is an electronics retailer in the state of India. He has collaborated with 7 other vendors who jointly import goods from China in one container. This helps them to share the cost of a container which is usually accessible to only big organizations that has a large order.

23. Do Not Purchase In Bulk

You will be surprised. Usually, small businesses purchase things such as office supplies in bulk as it seems less costly to buy that way. For example, if you buy 500 sets of printing paper, your cost per set will be low than if you purchase them one at a time. But you have to question yourself. How faster you will consume 500 sets of printing paper? Importantly, you have either lost them or found that most of them are destroyed before you get around to using them.

As a small business owner, you could largely cut your costs by purchasing only what you require today – not what you think you’ll need the next day. The plan should be to improve the cash flow.

24. Monitor Inventory Closely To Get Cost Optimization

If you are in an inventory-based business, carrying low inventory means having less money blocked and more money in the bank. Begin checking inventory more closely to make sure you aren’t spending more than is really required. Apply Just In Time technology

If you manage stock manually, consider adopting inventory management software to keep better track.

25. Invest in Better Systems And Technology

There is only too much you can do to enhance your business as it is now. At some point, if you wish to see a truly effective margin, you need to relook at how you do business. And that is the move of organizational transformation.

That should not terrify you. And no, we are not talking about seven-figure plus new IT projects that may or may not generate a positive ROI.

Besides, we are talking about a strategic approach to increasing the functionality of your business by investing in systems designed to improve efficiencies and reduce costs. But to install those systems, you have to invest in the right and upgraded technology.

Fortunately, as referenced, low code makes it simple to fabricate custom applications and mixes for a small part of what custom application improvement costs. In any case, there is an underlying interest in the framework, preparation, and social shift.

Compelling business change begins with an expense-cutting procedure. And keeping in mind that different strategies on this rundown are tied in with eliminating costs, constructing better frameworks requires spending more cash presently realizing that the return on initial capital investment will pay out massively over the long run.

26. Team Up With Business Transformation Experts

There are a number of ways to optimize costs in your organization. Some are quick gains. Others will take some time. And even so, there are accesses that may end up doing more loss than good. That’s why if you would not wish to lose money trying to save money, you have to team up with business transformation specialists

Working with consultants who specialize and have expertise in business transformation will save you time and money while assuring any spend you make in better systems gets a high return.

Rather than get knotted up in business expense reduction, you require to work with a team that can leverage experience earned in multiple channels to assist you to avoid expensive mistakes and reduce waste faster.

27. Dump The Traditional Platforms

Traditional platforms are time and resource-consuming to maintain. On average, a firm invests $3.61 per line of code. With the mean-size application at 300,000 lines of code (LOC), that comes to $1,083,000 per application to sustain and fix legacy software.

Additionally, about 33% of engineers’ time goes to dealing with technical tasks. It is a waste of time on repairing existing software, not work on new innovations that could improve revenue.

28. Leverage Low Code Systems

Low code offers an easily outgoing answer to lower inefficiencies while optimizing costs in businesses of any size.

In short, low-code systems make it simple for anyone to quickly shift and drop new applications into existence. All without broad coding, testing, or working of back-end foundation.

As a result, you can make the apps you require and link them to your existing platforms at a fraction of the cost of traditional, custom app constructs. By doing this, you’ll be able to grade your systems to support your expanding business without diverting your budget on IT resources.

Further, you can train your team to become citizen developers i.e.full-time workers who can easily make the technical solutions they required. With citizen developers, you can reduce IT costs without compromising quality. This leads to faster (and more affordable) application improvement and more business agility.

Conclusion

With little thinking and experience, you can find out ways to reduce costs and save money in your business. It always helps to communicate with fellow entrepreneurs and know the best ways to save money from their experiences.

The question “how to optimize business cost?” may still come to many people’s minds. Therefore, the answer to this question you have to manage your time efficiently, and being patient and easy-moving can help you do the same effortlessly. The above-explained techniques can surely help you insight into your business costs, budget, and the things which are unwanted and need to be cut down. Therefore, these techniques will surely help you cut your business expenses without letting go of your valuable employees.

Answer covered -People also asked

- What are the 6 types of cost savings?

- Which are the four best practices of cost optimization?

- Can you give 5 examples of techniques on how you reduce company costs?

- How do you get the best cost optimization?

- What are the four best practices of cost optimization in AWS?

- What is cost best optimization?

Disclaimers

All the information on this website – World Virtual CFO – is published in good faith and for general information purposes only. World Virtual CFO does not make any warranties about the completeness, reliability, and accuracy of this information. Any action you take upon the information you find on this website (World Virtual CFO), is strictly at your own risk. World Virtual CFO will not be liable for any losses and/or damages in connection with using our website. For details please refer to our disclaimer page.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.