Introduction- Entry-Level Budgeting Tips

Entry-Level Budgeting Tips-College is a time of incredible personal growth, and one of the most important areas where students gain independence is financial responsibility. For many, it’s the first time managing income, expenses, and savings without direct parental oversight. While the newfound autonomy is exciting, it also brings challenges—especially for those unfamiliar with how to manage money effectively. Whether you’re supporting yourself through part-time work or living on financial aid, these seven expanded tips will empower you to take control of your financial future with confidence.

1. Track Every Dollar You Spend

The key to mastering your money is knowing exactly where it goes. Tracking your income and expenses might seem tedious, but it lays the foundation for financial success. Use apps like Mint, PocketGuard, or YNAB (You Need a Budget) to categorize transactions and monitor spending habits. Prefer pen and paper? A budgeting notebook or Excel spreadsheet can do the trick. Analyze your spending at the end of each week and identify trends. Are you overspending on takeout or entertainment? Awareness is the first step to making meaningful changes.

2. Set a Monthly Spending Plan That Reflects Your Reality

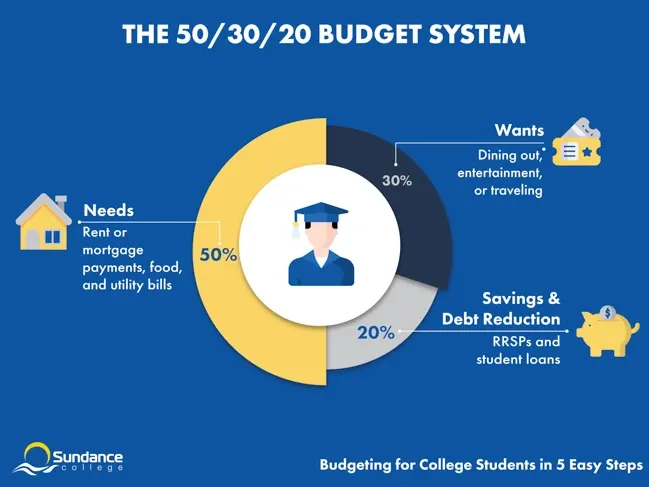

Creating a realistic monthly budget based on your specific financial situation is essential. Start with your total income—whether it’s from a part-time job, scholarships, or parental support. Divide it into fixed expenses (rent, tuition, utilities), flexible expenses (groceries, transportation), and discretionary spending (dining out, shopping). Try the 50/30/20 rule as a flexible guide: 50% for needs, 30% for wants, and 20% for savings or debt. Review and tweak your plan monthly to accommodate any financial changes.

3. Distinguish Between Needs and Wants– Entry-Level Budgeting Tips

Learning the difference between what you need and what you want can significantly reduce unnecessary spending. Needs include items vital for your education and survival—textbooks, rent, food, and basic supplies. Wants are the extras—concert tickets, premium coffee, late-night online shopping. That doesn’t mean you can’t enjoy life, but prioritizing essentials helps you avoid financial stress. One trick? Create a “wish list” and delay gratification—revisit it in a week to see if you still want it.

4. Embrace the Power of Student Discounts-Entry-Level Budgeting Tips

As a student, you have access to a wide array of discounts that can help stretch your dollar. Retailers, streaming platforms, restaurants, and software companies offer exclusive student pricing. Sign up for platforms like UNiDAYS, Student Beans, or ID.me to access ongoing deals. Don’t forget your school ID—many local businesses offer discounts just for showing it. Maximize savings on everyday essentials, travel, and subscriptions.

5. Use Cash Envelopes or Digital Alternatives for Discretionary Spending

The envelope method is a classic budgeting system that helps limit overspending. Allocate a set amount of cash or digital funds to categories like entertainment, eating out, or clothing. Once the envelope is empty, you’re done spending in that area for the month. Prefer digital tools? Apps like Qube Money or Goodbudget simulate the envelope system and help enforce financial discipline in a cashless world.

6. Build an Emergency Fund Slowly and Steadily– Entry-Level Budgeting Tips

An emergency fund is your financial safety net for unplanned events—medical bills, laptop repairs, travel emergencies. Start small: aim for $300 to $500 initially. Set up an automatic transfer from your checking to savings account weekly. Even $5 per week adds up. Consider using high-yield savings accounts or round-up apps that stash spare change from debit card purchases. This money buys you peace of mind when life throws a curveball.

7. Avoid Credit Card Debt Like the Plague– Entry-Level Budgeting Tips

Credit cards can be helpful if used wisely—but dangerous if mismanaged. Use your card only for planned purchases and pay off the balance in full each month. Set up autopay and calendar reminders to avoid late payments. Choose a student-friendly credit card with no annual fee and a low-interest rate. Responsible credit use builds a healthy credit score, which can benefit you long after college when applying for jobs, apartments, or loans.

Conclusion– Entry-Level Budgeting Tips

Budgeting may seem complicated at first, but it’s a skill that pays off exponentially. By applying these entry-level budgeting tips consistently, college students can reduce anxiety around money, prevent debt, and take charge of their future. Financial literacy is empowering—use these strategies to build habits that will serve you throughout college and beyond. Remember, every dollar has a job. Make sure yours are working for you.

📘 Frequently Asked Questions (FAQs) – Entry-Level Budgeting Tips for College Students

💡 1. Why is budgeting important for college students?

Budgeting helps students manage limited resources effectively, avoid debt, and build financial independence. It’s a foundational skill that supports responsible spending and long-term financial stability.

📊 2. What’s the best way to start budgeting as a beginner?

Start by tracking every dollar you spend. Use budgeting apps like Mint, YNAB, or PocketGuard, or maintain a simple spreadsheet. Categorize your expenses and analyze them weekly to identify spending patterns.

🧮 3. How do I create a realistic monthly budget?

Begin with your total monthly income (from jobs, scholarships, or parental support). Allocate funds using the 50/30/20 rule:

- 50% for needs (rent, food, tuition)

- 30% for wants (entertainment, shopping)

- 20% for savings or debt repayment

Adjust monthly based on changes in income or expenses.

🛍️ 4. What’s the difference between needs and wants?

Needs are essentials like rent, groceries, and textbooks.

Wants are non-essentials like dining out, concert tickets, or branded clothing. Prioritizing needs helps avoid financial stress and overspending.

🎓 5. How can I save money using student discounts?

Sign up for platforms like UNiDAYS, Student Beans, and ID.me to access exclusive student deals. Always carry your student ID—many local businesses offer discounts on food, travel, and services.

💵 6. What is the envelope method and how does it work?

The envelope method involves allocating a fixed amount of cash (or digital funds) to spending categories like entertainment or dining out. Once the envelope is empty, you stop spending in that category. Apps like Qube Money and Goodbudget offer digital versions of this system.

🛑 7. How can I avoid credit card debt in college?

- Use credit cards only for planned purchases

- Pay off the full balance monthly

- Set up autopay and reminders

- Choose student-friendly cards with no annual fees and low interest rates

Responsible use builds a strong credit score without accumulating debt.

🏦 8. How much should I save in my emergency fund?

Start with a goal of ₹2,500–₹5,000 ($300–$500). Set up automatic weekly transfers—even ₹400/week adds up. Use high-yield savings accounts or round-up apps to grow your fund gradually.

📱 9. Are budgeting apps safe to use?

Yes, most reputable budgeting apps use bank-level encryption and secure authentication. Always read reviews and privacy policies before linking your financial accounts.

📈 10. Can budgeting really reduce stress?

Absolutely. Knowing where your money goes and having a plan reduces financial anxiety. It empowers you to make informed decisions and prepares you for unexpected expenses.

Disclaimer

This article relies on internal data, publicly available information, and other reliable sources. It may also include the authors’ personal views. However, it’s essential to note that the information is for general, educational, and awareness purposes only—it doesn’t disclose every material fact. This analysis is for informational purposes only and does not constitute financial advice. Consult a professional before making investment decisions.

We publish information on World Virtual CFO in good faith, solely for general information. World Virtual CFO doesn’t guarantee the completeness, reliability, or accuracy of this information. These are our views for informational purposes. When you use our website, know that any action you take is entirely at your own risk. World Virtual CFO won’t be liable for any losses or damages connected to your use of our website. For detailed information, refer to our disclaimer page.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.

Comments are closed.