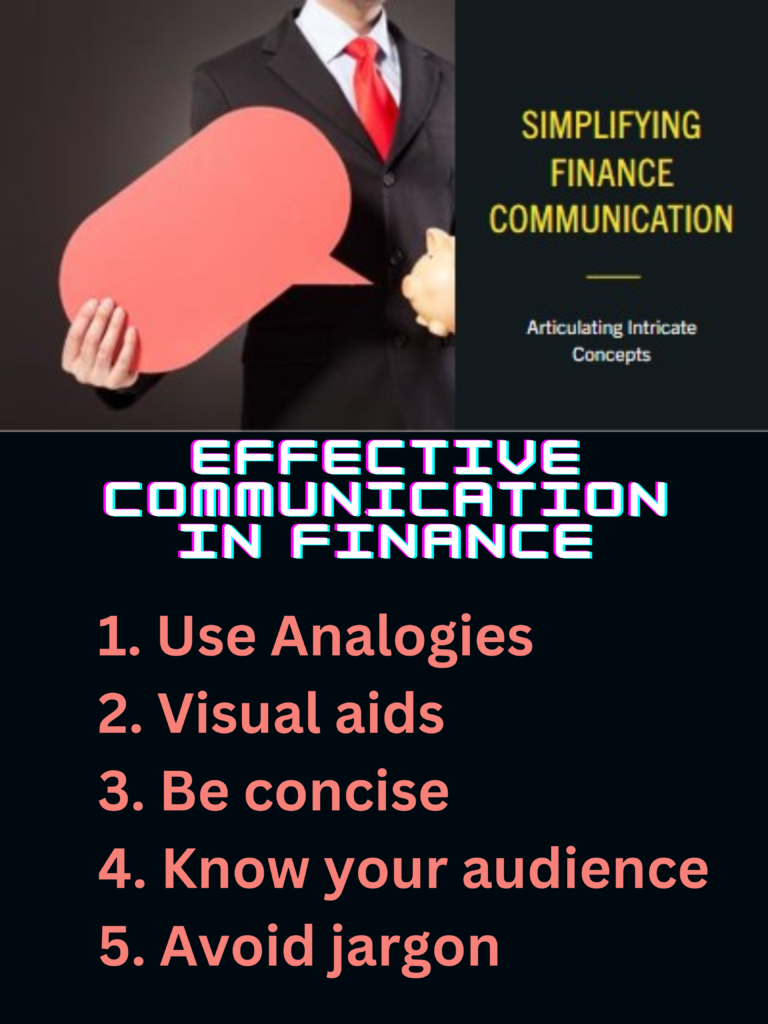

In the world of finance, effective communication is not just a tool; it’s a necessity. Conveying intricate financial concepts in a straightforward manner is pivotal. Communication is a crucial aspect of the finance profession. It is essential to convey complex financial concepts in a simple and understandable manner. In this blog post, we will discuss how effective communication in finance can be achieved.

- Importance of Effective Communication in Finance

- Articulating Intricate Concepts with Simplicity

- 1. Use analogies:

- 2. Visual aids

- 3. Be concise:

- 4. Know your audience:

- 5. Avoid jargon:

- Some other ways For Effective Communication in Finance

- Conclusion: Effective Communication in Finance

- Answer Covered for People also ask

- Disclaimer

Importance of Effective Communication in Finance

Effective communication is essential in the finance profession as it helps to build trust and credibility with clients. It is also crucial for making informed decisions and ensuring that everyone is on the same page. Poor communication can lead to errors, misunderstandings, and even financial losses.

Articulating Intricate Concepts with Simplicity

One of the most challenging aspects of communication in finance is articulating intricate concepts with simplicity. Finance professionals are often required to explain complex financial concepts to clients who may not have a background in finance. Therefore, it is essential to break down these concepts into simple terms that anyone can understand.

Here are 5 tips for Effective Communication in Finance: articulating intricate concepts with simplicity:

1. Use analogies:

Analogies are a great way to explain complex financial concepts in simple terms. For example, you can use the analogy of a household budget to explain the concept of a company’s financial statements.

2. Visual aids

Visual aids such as graphs, charts, and diagrams can help to explain complex financial concepts in a simple and understandable manner. For instance, you Here are some more examples of visual aids that can use in financial reporting:

2.1 Time-series line graphs: These graphs can use to show financial metrics such as revenue and cost of sales over time. They can help stakeholders identify trends, like seasonality and rates of growth (or decline), that can use to interpret historical performance and project it into the future.

2.2 Bar graphs: Data groups into rectangular bars in lengths proportionate to the values they represent so data can compare and contrasted. An organization might use this type of graph to show revenue by product line or geographic region to find what (or who) is selling the most.

2.3 Pie charts: You can use a pie chart to show the percentage of revenue generated by each product line. These circular models flash parts of a whole, dividing data into slices like a pizza. They might use in financial reporting to present the composition of an organization’s operating expenses for budgeting or cost-cutting projects.

2.4 Tables: This simple format presents key figures in a table with rows and columns. To summarize complex time-series data, a table can be effective for example. It can provide a quick reference for information investors may wish to refer to in the future, such as gross profit margin or EBITDA over the last five years.

3. Be concise:

When communicating financial information, it is essential to be concise and to the point. Avoid using unnecessary words or information that may confuse your audience. For example, instead of saying “The company’s net income for the year was $1,000,000,” you can say “The company earned $1,000,000 in net income this year.”

4. Know your audience:

Understanding your audience is crucial when it comes to effective communication. You need to know who you are speaking to and what their level of understanding is. This will help you tailor your message to their requirements and ensure that they understand the information, which you are presenting.

5. Avoid jargon:

Jargon can be confusing and intimidating for people who are not familiar with finance. Therefore, it is essential to avoid using jargon and technical terms when communicating with clients. Instead, use simple and easy-to-understand language.

Some other ways For Effective Communication in Finance

There are several other ways to communicate financial information effectively. Here are some examples:

1. Infographics:

Infographics are a visual representation of data that can help to simplify complex financial information. They can use to show trends, comparisons, and other financial metrics in a simple and easy-to-understand format.

An example of a financial infographic that shows the distribution of expenses for a typical household: Infographic on the distribution of expenses for a typical household

This infographic uses a pie chart to show the percentage of expenses for each category, such as housing, transportation, and food. The use of colors and labels makes it easy to understand the information presented.

Creating effective infographics requires a combination of creativity and data analysis. Here are some tips to help you get started:

1.1 Define your objective: Before you start creating your infographic, you need to define your objective. What message do you want to convey? Who is your target audience? What data do you need to include?

1.2 Choose the right format: There are many different formats for infographics, including timelines, flowcharts, and comparison charts. Select the format that best suits your data and your message.

1.3 Keep it simple: Infographics should be easy to read and understand. Avoid messing your infographic with too much information or using too many colors.

1.4 Use visuals: Infographics are all about visuals. Use icons, images, and graphs to help convey your message.

1.5 Tell a story: Infographics should tell a story. Use your data to create a narrative that engages your audience and keeps them interested.

1.6 Make it shareable: Infographics are a great way to generate buzz and drive traffic to your website. Make sure your infographic is easy to share on social media and other platforms.

2. Videos: Effective Communication in Finance

Videos can be an effective way to communicate financial information. They can be used to explain complex financial concepts in a simple and engaging manner. Videos can also be used to provide financial advice and tips to clients.

3. Interactive tools:

Interactive tools such as calculators and simulators can help clients to understand complex financial concepts. They can be used to show the impact of different financial decisions and help clients make informed decisions.

4. Reports: Effective Communication in Finance

Reports can be used to communicate financial information in a detailed and comprehensive manner. They can be used to provide an overview of a company’s financial performance, as well as detailed information on specific financial metrics.

5. Presentations:

Presentations can be an effective way to communicate financial information to clients. They can be used to provide an overview of financial performance, as well as detailed information on specific financial metrics. Presentations can also be used to provide financial advice and tips to clients.

Conclusion: Effective Communication in Finance

Effective communication in finance profession is essential. It helps to build trust and credibility with clients, ensures that everyone is on the same page, and can even help to prevent financial losses. By following these tips, you can communicate complex financial concepts in a simple and understandable manner. Effective communication is essential in the finance profession as it helps to build trust and credibility with clients, ensures that everyone is on the same page, and can even help to prevent financial losses.

Answer Covered for People also ask

1.What are the 5 importance of effective communication?

2.What are 5 ways to communicate effectively?

3.What are the 5 processes for effective communication?

4.What are the 5 keys areas of effective communication?

Disclaimer

This article has been created on the basis of internal data, information available publicly, and other reliable sources to be believed. The article may also include information which are the personal views/opinions of the authors. The information included in this article is for general, educational, and awareness purposes only and is not a full disclosure of every material fact.

All the information on this website i.e. World Virtual CFO – is published in good faith and for general information purposes only. World Virtual CFO does not make any warranties about the completeness, reliability, and accuracy of this information. These are my views for only information purposes. Any action you take upon the information you find on this website (World Virtual CFO), is strictly at your own risk. World Virtual CFO will not be liable for any losses and/or damages in connection with using our website. For details please refer to our disclaimer page.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.