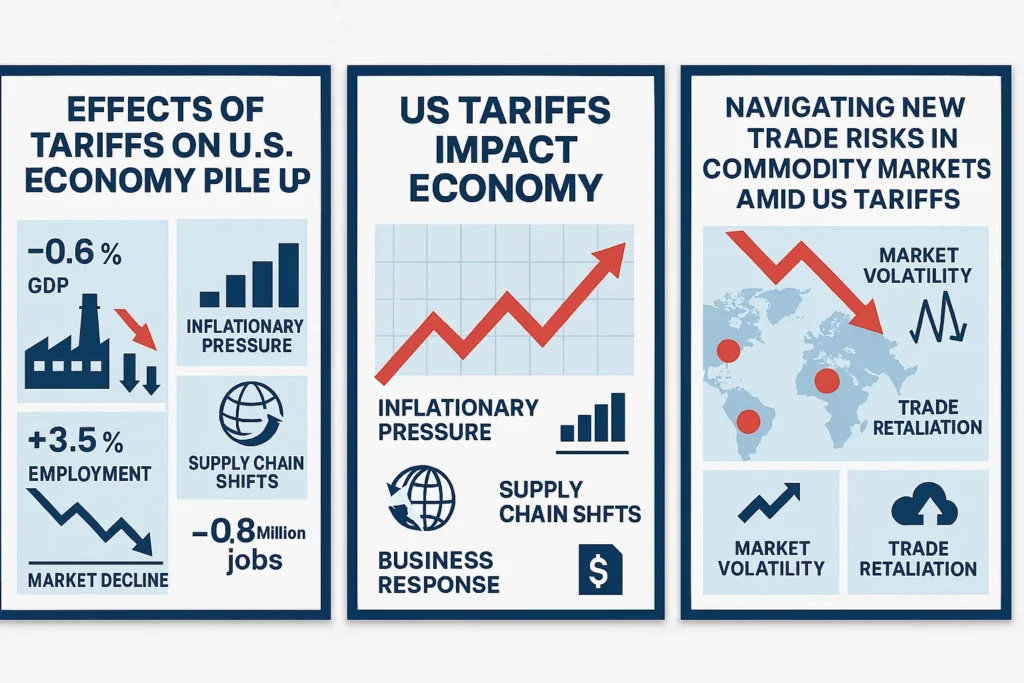

US tariffs impact markets in powerful and far-reaching ways. From inflation and stock market volatility to international trade, currency movements, corporate profits, and consumer prices, new or adjusted tariffs can send deep and lasting ripples across the global economy. Whether you’re a trader, investor, business owner, policymaker, or simply someone trying to understand your grocery bill or portfolio performance, this comprehensive guide breaks down exactly how U.S. tariffs influence markets—and what critical economic shifts you should monitor.

- What Are US Tariffs and Why Do They Matter?

- 1. Stock Market Volatility Spikes with Tariff Announcements

- 2. Consumer Prices Rise Over Time-US tariffs impact markets

- 3. Supply Chain Disruptions Ripple Through Industries

- 4. Trade Wars Strain Diplomacy and Shake Currency Markets

- 5. Investors Shift Toward Safer, Domestic-Focused Assets

- Historical Context: Past Tariff Impacts on Markets

- How to Navigate a Tariff-Driven Market-US tariffs impact markets

- Frequently Asked Questions (FAQs)-US tariffs impact markets

- Conclusion: Understanding the Bigger Picture (US tariffs impact markets)

- Affiliate & Legal Disclaimer

What Are US Tariffs and Why Do They Matter?

Tariffs are taxes imposed by the U.S. government on imported goods and services. Typically charged as a percentage of the item’s declared value, these duties serve a variety of political and economic purposes:

- To protect domestic industries from cheaper foreign competition

- To boost demand for American-made goods and services

- Punishing or deter unfair trade practices, such as intellectual property theft or dumping

- Serving as leverage in trade negotiations

In today’s globalized economy, these taxes can have an outsized effect. They influence the behavior of multinational corporations, shift trade flows between countries, and change how consumers and businesses make decisions. Tariffs can be part of strategic national policy, but they also frequently lead to unintended economic consequences.

1. Stock Market Volatility Spikes with Tariff Announcements

Every time new tariffs are announced or existing ones adjusted—whether targeting China, the EU, or other nations—the U.S. stock market tends to react quickly. Often, these responses occur within hours or even minutes, long before the actual policy is implemented. That’s because investors fear potential:

- Lower corporate earnings due to increased input costs

- Disrupted global supply chains

- Retaliation from foreign governments

Sectors Most Affected by Tariff Announcements: US tariffs impact markets

- Manufacturing (e.g., autos, machinery)

- Technology (e.g., chips, smartphones)

- Agriculture (e.g., soybeans, pork)

Indices to Watch: US tariffs impact markets

- Dow Jones Industrial Average (DJIA)

- NASDAQ Composite (especially tech-heavy stocks)

- S&P 500 (for broader economic signals)

Example: During the U.S.–China trade war of 2018–2019, each escalation in tariffs or rhetoric sparked massive swings in equity markets. Apple, Boeing, and other global exporters lost billions in market capitalization in single-day declines.

2. Consumer Prices Rise Over Time-US tariffs impact markets

One of the most tangible ways US tariffs impact markets is through rising consumer prices. Tariffs act like a hidden tax. Importers and retailers often pass the added costs down the line, directly affecting the cost of everyday goods.

Impact on Daily Life: US tariffs impact markets

- Food: Higher prices for imported meats, fruits, and vegetables

- Electronics: Increased costs for smartphones, laptops, and home appliances

- Clothing: Especially for items manufactured in Asia

Although these price increases might not hit immediately (due to existing inventory or long-term contracts), they tend to accumulate over weeks or months. The result is a slow-burning inflationary pressure that erodes purchasing power, particularly for lower- and middle-income households.

Example: When the U.S. raised tariffs on washing machines, prices for those appliances jumped 12% in just six months, according to Consumer Reports.

3. Supply Chain Disruptions Ripple Through Industries

Global supply chains rely on just-in-time delivery, multi-tiered outsourcing, and lean inventories. Tariffs throw a wrench into this finely-tuned system. Companies may be forced to:

- Find alternative suppliers in less affected countries

- Reshuffle logistics and warehousing to avoid tariff hot zones

- Eat additional costs or risk passing them to customers

Examples of Disruption:

- Electronics companies like Apple had to reconsider production hubs in China

- Automakers faced delays in accessing foreign auto parts

- Retail giants like Walmart and Target scrambled to renegotiate supplier contracts

Tariff uncertainty makes it harder for firms to plan capital expenditures and expansions, which in turn affects employment, business confidence, and long-term innovation.

4. Trade Wars Strain Diplomacy and Shake Currency Markets

Tariffs rarely go unanswered. When the U.S. imposes tariffs, its trading partners often retaliate with tariffs of their own. This tit-for-tat behavior escalates into trade wars, which can:

- Damage diplomatic relationships

- Disrupt long-standing trade agreements

- Create instability in international markets

Currency markets are among the first to respond to these geopolitical tensions:

- The U.S. dollar may strengthen as investors seek safety

- Other countries may devalue their currency to maintain export competitiveness

- Forex markets experience extreme volatility, especially in USD/CNY, USD/EUR, and USD/JPY pairs

Financial Safe Havens During Trade Disputes: US tariffs impact markets

- Gold and silver

- U.S. Treasury bonds

- Swiss franc and Japanese yen

5. Investors Shift Toward Safer, Domestic-Focused Assets

When trade tensions rise, investors adjust their portfolios toward lower-risk, domestic-oriented assets. This can lead to:

- Outflows from international growth funds

- Increased interest in dividend-paying U.S. stocks

- Rotation from cyclical sectors to defensive sectors (such as healthcare, utilities, and consumer staples)

Long-term investors may also shift toward:

- Bonds and bond ETFs for lower volatility

- Precious metals ETFs as inflation hedges

- Real estate investment trusts (REITs) with U.S.-based holdings

Tip: Keep an eye on fund flows tracked by Morningstar or Bloomberg to see where institutional money is going during trade upheaval.

Historical Context: Past Tariff Impacts on Markets

1930s – Smoot-Hawley Tariff Act:

- Increased tariffs on over 20,000 goods

- Contributed to a global trade collapse during the Great Depression

2018–2019 – U.S.–China Trade War:

- Tariffs affected over $550 billion in trade

- Major volatility in tech stocks and agricultural markets

- Caused a temporary slowdown in global GDP growth

2025 and Beyond:

- Tariff proposals on semiconductors, EVs, pharmaceuticals, and rare earth minerals could reshape the landscape of tech, green energy, and health sectors in both the U.S. and abroad

How to Navigate a Tariff-Driven Market-US tariffs impact markets

To remain resilient in a tariff-affected market, take a proactive approach:

1.For Investors:

- Diversify globally—but hedge your exposure

- Favor U.S.-based firms with strong domestic demand

- Use options or inverse ETFs to mitigate downside risk

2.For Businesses: US tariffs impact markets

- Explore regional sourcing and local suppliers

- Build inventory buffers when possible

- Monitor tariff developments and consider trade attorneys or consultants

3.For Consumers: US tariffs impact markets

- Track which goods are subject to new tariffs

- Compare pricing trends with prior months

- Buy durable goods (like appliances or electronics) before tariff hikes take effect

Frequently Asked Questions (FAQs)-US tariffs impact markets

What is the purpose of tariffs?

Tariffs are used to protect domestic industries, raise revenue, punish unfair trade practices, or gain leverage in international negotiations. They can be economic tools or political weapons.

How do tariffs affect consumers?

Tariffs often lead to increased prices for imported goods, which may be passed on to consumers. This can make everyday items like food, electronics, and clothing more expensive.

Do tariffs benefit the U.S. economy?

They may benefit select industries in the short term by shielding them from competition. But over time, widespread tariffs often reduce trade efficiency, raise costs, and strain international relations—hurting the overall economy.

How quickly do tariffs impact the stock market?

The market often reacts within hours or even minutes of tariff announcements. Especially if it involves major economies, traders price in risk quickly—before the actual policy is implemented.

Are there any winners during a tariff war?

Yes. Some domestic producers, especially those in protected sectors, may benefit. Investors in safe-haven assets like gold or Treasury bonds also tend to gain.

Can tariffs cause a recession?

Not directly, but sustained trade wars can disrupt investment, slow hiring, reduce consumer spending, and damage confidence. Over time, this may push an economy toward stagnation or recession.

Where can I follow updates on tariff policy?

Stay updated with:

- U.S. Trade Representative (USTR.gov)

- Financial media outlets: Bloomberg, CNBC, Reuters

- Non-partisan policy centers: Brookings Institution, Peterson Institute for International Economics

Conclusion: Understanding the Bigger Picture (US tariffs impact markets)

The phrase “US tariffs impact markets” is more than a headline—it’s a macroeconomic truth. In an interconnected world, trade policy shapes not only financial markets but also business strategy, household budgets, and geopolitical dynamics. Whether you’re managing a portfolio or running a business, understanding tariff dynamics can help you better prepare for economic storms and navigate them with clarity.

Affiliate & Legal Disclaimer

This article relies on internal data, publicly available information, and other reliable sources. It may also include the authors’ personal views. However, it’s essential to note that the information is for general, educational, and awareness purposes only—it doesn’t disclose every material fact. This analysis is for informational purposes only and does not constitute financial advice. Consult a professional before making investment decisions. This article contains affiliate links from Amazon and ClickBank. If you purchase through these links, we may earn a commission—at no extra cost to you.

We publish information on World Virtual CFO in good faith, solely for general information. World Virtual CFO doesn’t guarantee the completeness, reliability, or accuracy of this information. These are our views for informational purposes. When you use our website, know that any action you take is entirely at your own risk. World Virtual CFO won’t be liable for any losses or damages connected to your use of our website. For detailed information, refer to our disclaimer page.

By carefully selecting and promoting relevant affiliate products, you can potentially earn income while providing value to your readers and enhancing their understanding of the S&P 500.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.

Comments are closed.