Great Crypto Predictions 2025-The cryptocurrency market has been one of the most exciting and volatile sectors of the financial world over the past decade. From the meteoric rise of Bitcoin to the explosion of DeFi (Decentralized Finance) and NFTs (Non-Fungible Tokens), digital assets have captured the attention of investors, entrepreneurs, and tech enthusiasts worldwide.

As 2025 approaches, experts are analyzing trends and making predictions about what the future holds for cryptocurrencies. Understanding these trends is essential for anyone who wants to make informed investment decisions, leverage blockchain technology, or simply stay ahead in this fast-evolving market.

This article provides an in-depth look at the top 10 crypto predictions 2025, offering insights, examples, and actionable takeaways. Whether you are an investor, a business owner, or a tech enthusiast, these predictions will help you navigate the crypto landscape in the coming year.

- Gaming: Play-to-earn models and in-game assets as NFTs.

- Virtual Real Estate: Digital land ownership in metaverse platforms.

- Intellectual Property Rights: NFTs can verify ownership of digital content and creative works.

- Digital Identity: NFTs may be used for secure identification and credentials.

- Total Value Locked (TVL) Increases: Analysts predict significant growth in TVL, indicating greater participation and liquidity in DeFi protocols.

- Institutional Involvement: More institutions may integrate DeFi into their investment strategies, adding credibility and stability.

- Innovation: Layer-2 scaling, synthetic assets, and cross-chain protocols will make DeFi more accessible and efficient.

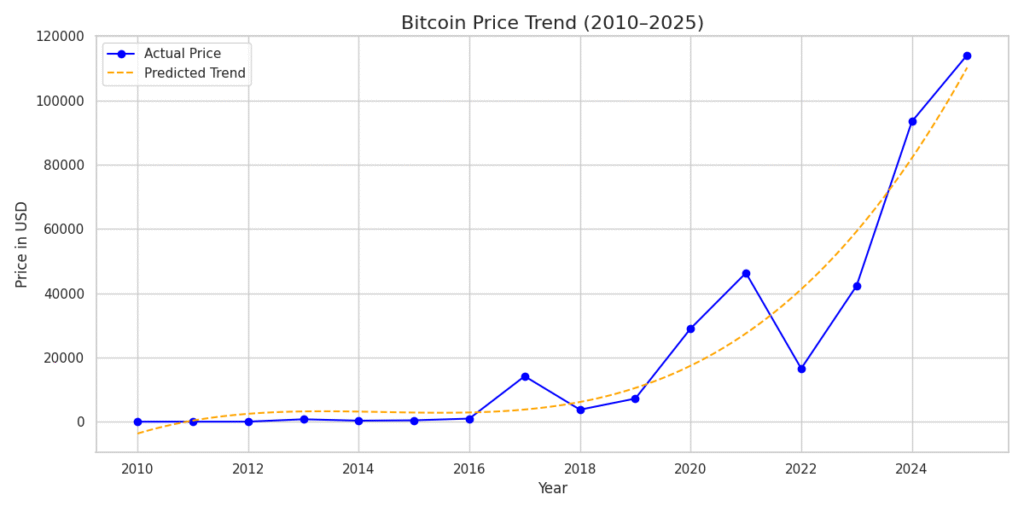

1. Bitcoin Continues to Lead the Market

Bitcoin, often referred to as digital gold, has been the cornerstone of the cryptocurrency market since its inception in 2009. By 2025, experts predict that Bitcoin will continue to dominate the market, both in terms of value and adoption.

Why Bitcoin Remains Relevant–Crypto Predictions 2025

- Institutional Adoption: Companies like Tesla, MicroStrategy, and several hedge funds have invested billions in Bitcoin. Institutional interest expected to increase in 2025, providing more liquidity and stability.

- Retail Adoption: Increasing accessibility through platforms like Coinbase, Binance, and Kraken makes Bitcoin more reachable for everyday investors.

- Hedge Against Inflation: Many see Bitcoin as a digital alternative to gold, providing protection against currency devaluation.

Risks and Considerations

Despite its dominance, Bitcoin is highly volatile. Price swings of 10–20% in a single day are not uncommon. Regulatory scrutiny and market sentiment can impact its value significantly.

| Projection | Crypto-Trend | Why It Matters in 2025 |

|---|---|---|

| 1 | Bitcoin could hit $150,000 | Strong demand + limited supply |

| 2 | Ethereum may lead Web3 growth | Smart contracts & DeFi boom |

| 3 | Rise of CBDCs worldwide | Governments entering crypto space |

| 4 | AI + Blockchain integration | Smarter trading & security |

| 5 | New wave of crypto regulations | More trust, less scams |

| 6 | NFTs go mainstream in gaming | Digital ownership revolution |

| 7 | Stablecoins gain global adoption | Safer payments worldwide |

| 8 | Green crypto projects dominate | Eco-friendly mining rise |

| 9 | Decentralized Finance 2.0 | More secure DeFi platforms |

| 10 | Meme coins evolve or vanish | Survival of the fittest |

2. Ethereum 2.0 and Beyond-Crypto predictions 2025

Ethereum, the world’s second-largest cryptocurrency, is undergoing major transformations. The Ethereum 2.0 upgrade, transitioning from proof-of-work to proof-of-stake, designed to address scalability, security, and energy efficiency.

Key Benefits of Ethereum 2.0

- Scalability: Ethereum 2.0 will process more transactions per second, reducing network congestion.

- Lower Fees: Reduced gas fees make it more affordable for users to engage with decentralized applications (dApps).

- Energy Efficiency: The transition reduces Ethereum’s energy consumption by over 99%, making it environmentally sustainable.

Ethereum powers thousands of dApps, including DeFi platforms, gaming, and NFT marketplaces. By 2025, the upgraded network expected to attract even more developers and businesses.

3. DeFi Ecosystem Expands-Crypto predictions 2025

Decentralized Finance (DeFi) has disrupted traditional financial systems by offering services like lending, borrowing, staking, and yield farming without intermediaries.

DeFi Growth Predictions for 2025

Risks

Smart contract vulnerabilities, hacks, and regulatory uncertainty remain challenges for the DeFi ecosystem. Proper research and risk management are critical.

4. NFTs Move Beyond Collectibles-Crypto predictions 2025

NFTs exploded onto the scene as digital collectibles and art assets. By 2025, NFTs are expected to evolve into practical use cases beyond collectibles.

Potential Applications

NFTs provide creators and businesses with new revenue streams and opportunities for innovation.

5. Central Bank Digital Currencies (CBDCs) Gain Traction

Central Bank Digital Currencies (CBDCs) are digital forms of national currencies issued by governments. While not cryptocurrencies in the traditional sense, CBDCs are influencing the digital asset ecosystem.

Expected Developments by 2025

- Global Adoption: Countries like China, Sweden, and the Bahamas are already piloting CBDCs. More nations are expected to launch digital currencies by 2025.

- Efficiency & Security: CBDCs offer faster, cheaper, and more secure transactions.

- Market Influence: Widespread CBDC adoption may coexist with cryptocurrencies, affecting supply, demand, and regulatory frameworks.

6. Layer-2 Solutions Become Standard-Crypto predictions 2025

Layer-2 solutions improve the performance of blockchain networks by handling transactions off the main chain, reducing congestion, and lowering fees.

Examples–Crypto predictions 2025

- Bitcoin Lightning Network: Speeds up Bitcoin transactions and reduces costs.

- Ethereum Rollups: Aggregate multiple transactions into a single one for efficiency.

- Adoption: By 2025, Layer-2 technologies are expected to be widely adopted, making crypto faster and more accessible to mainstream users.

7. Regulatory Clarity Encourages Adoption

Regulations shape the crypto landscape. By 2025, clearer legal frameworks are anticipated in many countries.

Positive Impacts– Crypto predictions 2025

- Investor Protection: Regulations can prevent fraud, scams, and market manipulation.

- Institutional Adoption: Legal clarity attracts banks, investment funds, and large corporations.

- Global Compliance: Standardized rules can facilitate cross-border crypto transactions.

While stricter regulation may limit certain activities, it adds credibility and fosters long-term growth.

8. Integration with Traditional Finance

Cryptocurrencies are increasingly bridging the gap with traditional finance.

Examples

- Crypto ETFs & Funds: Offering exposure to digital assets through traditional investment vehicles.

- Banking Services: Banks integrating crypto custody and trading options.

- Payment Platforms: Visa, Mastercard, and PayPal expanding crypto acceptance.

By 2025, crypto will likely be integrated into daily financial activities, making it easier for users to transact and invest.

9. AI and Blockchain Convergence

Artificial Intelligence (AI) is transforming how blockchain data is analyzed and used.

Applications

- Smart Trading: AI algorithms predict market movements and optimize trading strategies.

- Risk Management: AI identifies vulnerabilities in smart contracts and blockchain networks.

- Predictive Analytics: Helps investors and businesses make informed decisions.

By 2025, the combination of AI and blockchain is expected to enhance efficiency, security, and adoption across the crypto ecosystem.

10. Sustainable Crypto Initiatives-Crypto predictions 2025

Environmental concerns have been a major criticism of crypto mining, especially proof-of-work networks.

Green Innovations

- Renewable-Powered Mining: Solar, wind, and hydroelectric energy powering mining operations.

- Proof-of-Stake Protocols: Ethereum and other networks adopting energy-efficient alternatives.

- Sustainable Tokenomics: Incentives for eco-friendly projects and carbon offsetting.

By 2025, sustainability will become a key factor in blockchain development and adoption.

Conclusion-Crypto predictions 2025

2025 is shaping up to be a transformative year for cryptocurrencies. From Bitcoin and Ethereum to NFTs, DeFi, AI integration, and sustainable blockchain initiatives, the digital asset landscape offers exciting opportunities—but also risks. Staying informed, performing thorough research, and adopting a cautious approach are essential for anyone looking to participate in this dynamic market.

🔹 Frequently Asked Questions on Crypto Predictions 2025

1. What are the top crypto predictions for 2025?

In 2025, experts predict more mainstream adoption of cryptocurrencies, stronger regulations, and wider use of blockchain in finance, supply chain, and healthcare. Bitcoin is expected to remain the leading digital asset, while altcoins like Ethereum, Solana, and AI-linked tokens could gain more traction.

2. Will Bitcoin reach $100,000 in 2025?

Some analysts believe Bitcoin could cross $100,000 by 2025, especially if institutional adoption continues and global regulations provide more clarity. However, this is not guaranteed as the market is highly volatile, and prices depend on global economic trends, investor demand, and regulations.

3. Is Ethereum still a good investment for 2025?

Yes, Ethereum remains a strong player because of its smart contract ecosystem and upgrades like Ethereum 2.0, which improve scalability and energy efficiency. With DeFi, NFTs, and Web3 projects mostly built on Ethereum, it is still expected to play a leading role in 2025.

4. Which new cryptocurrencies could boom in 2025?

AI-powered tokens, decentralized finance (DeFi) coins, and gaming/metaverse tokens have strong growth potential. Newer projects that solve real-world problems, like faster transactions or cross-chain compatibility, could see major gains in 2025. Always research before investing.

5. What risks should investors consider in 2025?

The biggest risks include regulatory crackdowns, market volatility, cybersecurity threats, and scams. Investors should also be prepared for sudden price crashes, as crypto remains unpredictable. Diversification and risk management are key.

6. How can I prepare my portfolio for crypto in 2025?

A good strategy is to diversify between established coins (like Bitcoin and Ethereum) and promising altcoins. Using hardware wallets for security, staying updated on regulations, and avoiding emotional trading can also help investors stay safer in 2025.

7. Will governments regulate crypto heavily by 2025?

Yes, stronger regulations are expected by 2025. Countries like the U.S., India, and those in the EU are already drafting frameworks. Regulations may make crypto safer for investors but could also affect privacy and decentralized finance projects.

8. Is AI going to influence crypto trading in 2025?

Absolutely. AI trading bots and predictive analytics are already being used, and by 2025, they are expected to become even more advanced. AI could help investors make faster, smarter trading decisions, though it also comes with risks if over-relied upon.

Disclaimer

This article has been created on the basis of internal data, information available publicly, and other reliable sources to be believed. The article may also include information which are the personal views/opinions of the authors. The information includes in this article is for general, educational, and awareness purposes only and is not a full disclosure of every material fact.

All the information on this website i.e. World Virtual CFO – is published in good faith and for general information purposes only. World Virtual CFO does not make any warranties about the completeness, reliability, and accuracy of this information. These are my views for only information purposes. Any action you take upon the information you find on this website (World Virtual CFO), is strictly at your own risk. World Virtual CFO will not be liable for any losses and/or damages in connection with using our website. For details please refer to our disclaimer page.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.

Comments are closed.