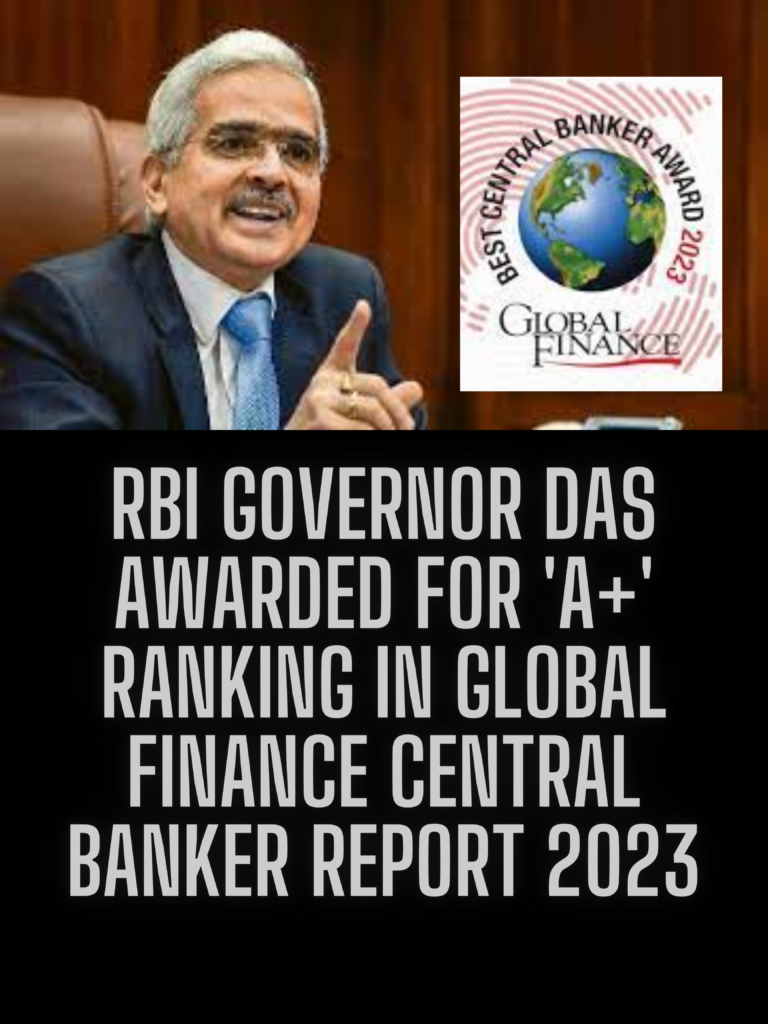

The Reserve Bank of India (RBI) honored Governor Shaktikanta Das with an ‘A+’ rating in the Global Finance 2023 Central Banker Report Cards. This accolade acknowledges central bank governors who have demonstrated outstanding leadership in their respective countries. Das is one of three central bank chiefs who achieved an ‘A+’ grade in the report.

The Global Finance Central Banker Report Cards assess the world’s leading central bankers on a scale from A to F, using both objective and subjective metrics. Global Finance editors compile this report in collaboration with financial industry sources, evaluating performance from July 1, 2022, to June 30, 2031. The report also features interviews with central bank governors regarding the past year and the future. It recognizes central bank governors whose strategies have surpassed their peers through originality, creativity, and determination.

Governor Shaktikanta Das Recognized with ‘A+’ Rating in Global Finance 2023

- Global Finance 2023 Central Banker Report Cards: A Trusted Benchmark

- The Global Finance 2023 Central Banker Report Cards: How They Work

- Other ‘A+’ Graded Central Bank Chiefs

- Understanding the Federal Reserve of the United States

- Notable Members of the Federal Open Market Committee (FOMC)

- Appointment Process for FOMC Members

- Disclaimer

Governor Shaktikanta Das of the Reserve Bank of India (RBI) achieves an ‘A+’ rating in the Global Finance Central Banker Report Cards for 2023, a noteworthy accomplishment. This rating reflects his exceptional leadership within the global community of central bank governors. He stands among the elite, being one of just three central bank chiefs to attain this prestigious ‘A+’ grade.

In a significant turn of events, Governor Shaktikanta Das, representing the Reserve Bank of India (RBI), receives an ‘A+’ rating in the Global Finance Central Banker Report Cards for 2023. This recognition occurred during an event held in Marrakesh, Morocco, where central bank leaders were celebrated for their exceptional strategies and leadership. Governor Shaktikanta Das secured the top position among three central bank governors who received an ‘A+’ grade. The other recipients of this honor are Switzerland’s Thomas J Jordan and Vietnam’s Nguyen Thi Hong..

Global Finance 2023 Central Banker Report Cards: A Trusted Benchmark

The Global Finance Central Banker Report Cards, an annual publication since 1994. It set the standard for evaluating central bank governors in 101 key countries, territories, and districts. These ratings, graded from A to F, evaluate success in critical areas like inflation control, economic growth, currency stability, and interest rate management. An ‘A’ grade denotes outstanding performance, while an ‘F’ signifies a lack of success. Global Finance well-regards for recognizing top performers among financial institutions. And providers of financial services, thus establishing a benchmark for excellence in the global financial community.

The Global Finance 2023 Central Banker Report Cards: How They Work

The Global Finance Central Banker Report Cards is an annual evaluation that rates the world’s foremost central bankers using a grading scale from A to F. This assessment is based on a combination of objective and subjective criteria. The report compiled by Global Finance editors in consultation with financial industry experts. Ratings are determined by the central bankers’ performance during the period from July 1, 2022, to June 30, 2023. Key metrics include the effective implementation of monetary policy tailored to the economic conditions of their respective countries. The report also features interviews with central bank governors, reflecting on the past year and offering insights into the future.

Other ‘A+’ Graded Central Bank Chiefs

Joining Governor Shaktikanta Das in receiving an ‘A+’ grade in the Global Finance Central Banker Report Cards for 2023 are Jerome Powell, Chairman of the Federal Reserve of the United States, and Haruhiko Kuroda, Governor of the Bank of Japan.

Understanding the Federal Reserve of the United States

The Federal Reserve of the United States, established by Congress in 1913, functions as the central bank of the United States. Its role includes managing monetary policy and overseeing the financial system. The Federal Reserve System consists of 12 regional banks, a board of governors, and a Federal Open Market Committee (FOMC). The FOMC is responsible for setting monetary policy by adjusting the federal funds rate, which serves as the overnight interest rate for interbank lending. Additionally, the Federal Reserve supervises and regulates banks and other financial institutions to ensure the stability of the financial system.

Notable Members of the Federal Open Market Committee (FOMC)

The Federal Open Market Committee (FOMC) comprises 12 members. Which including the seven members of the Board of Governors of the Federal Reserve System, the president of the Federal Reserve Bank of New York. And four of the remaining eleven Reserve Bank presidents who serve one-year terms on a rotating basis. Some notable members of the FOMC include Jerome Powell, Lael Brainard, Michael Barr, and Michelle Bowman, among others.

Appointment Process for FOMC Members

The appointment process for FOMC members involves the President of the United States nominating candidates for the Board of Governors, with confirmation by the Senate. The President also designates one member of the Board as Chair and another as Vice Chair. For Reserve Bank presidents, each Reserve Bank has a nine-member board of directors. And with three directors appointed by the Board of Governors and six directors elected by member banks in each Reserve Bank’s district. The appointment of Reserve Bank presidents is subject to approval by the Board of Governors.

Disclaimer

This article has been created on the basis of internal data, information available publicly, and other reliable sources to be believed. The article may also include information which are the personal views/opinions of the authors. The information includes in this article is for general, educational, and awareness purposes only and is not a full disclosure of every material fact.

All the information on this website – World Virtual CFO – is published in good faith and for general information purposes only. World Virtual CFO does not make any warranties about the completeness, reliability, and accuracy of this information. These are my views for only information purposes. Any action you take upon the information you find on this website (World Virtual CFO), is strictly at your own risk. World Virtual CFO will not be liable for any losses and/or damages in connection with using our website. For details please refer to our disclaimer page.

Dr. Dinesh Sharma is an award-winning CFO and AI strategist with over two decades of experience in financial leadership, digital transformation, and business optimization. As the founder of multiple niche platforms—including WorldVirtualCFO.com—he empowers professionals and organizations with strategic insights, system structuring, and innovative tools for sustainable growth. His blogs and e-books blend precision with vision, making complex financial and technological concepts accessible and actionable.

2 thoughts on “RBI Governor Das Gets A+ Global Finance 2023: Great Award”